Most breweries would describe their tunnel pasteurizer as stable and reliable. It runs every day, meets quality requirements, and rarely becomes the source of urgent operational issues. From an operational perspective, it appears to be doing exactly what it was designed to do.

In many facilities, however, that same pasteurizer is quietly limiting revenue growth. Not because it is failing or out of compliance, but because it is being operated conservatively without the data required to understand its true capacity.

The result is a form of loss that does not show up as downtime, scrap, or failed audits, but instead appears as constrained throughput and unrealized revenue.

Pasteurization as an Operational Constraint

In most packaged beverage operations, tunnel pasteurization is the rate-limiting step. While upstream processes such as fermentation, blending, and filling can often scale incrementally, every product must pass through the tunnel before it can ship. The pasteurizer, therefore, sets a hard ceiling on how much volume can leave the facility.

To reduce risk, breweries typically operate tunnel pasteurizers with wide safety margins, including:

- Reduced conveyor speeds to ensure worst-case understanding across all packages

- Elevated water temperatures are used as a blanket safeguard against variability

- Legacy tunnel settings are applied across multiple SKUs regardless of actual lethality requirements

Each of these decisions is reasonable from a food safety standpoint. Collectively, however, they suppress throughput and create hidden inefficiencies that compound over time.

The Source of Invisible Throughput Loss

Pasteurization performance is governed by Pasteurization Units (PUs), which measure cumulative thermal lethality delivered over time. From a regulatory and quality standpoint, what matters is whether the geometric cold spot inside the package reaches the required PU threshold.

Most breweries do not continuously measure this cold spot. Instead, they rely on indirect indicators such as

- Water temperature readings

- External or surface measurements

- Periodic manual spot checks

These methods confirm that the process is safe, but they do not quantify how much margin exists above the minimum requirement. As a result, many tunnel pasteurizers operate with 3–5% of total capacity sitting unused, simply because operators lack the visibility to safely reclaim it.

This loss does not appear as an obvious operational problem. It shows up instead as missed volume targets, additional shifts, or pressure to invest in new equipment.

What That Lost Capacity Actually Costs

Consider a representative mid-sized brewery operating a tunnel pasteurizer at approximately:

- 300 cans per minute

- 6 hours per day

- 5 days per week

- 52 weeks per year

That equates to roughly 30 million cans annually.

If conservative pasteurization settings reduce achievable throughput by just 3%, the financial impact is significant:

- ~842,000 cans per year are not produced

- ~$1.00 contribution margin per can

- $842,000 in lost annual profit

This loss is structural, not episodic. It repeats every year until the underlying constraint is addressed, which is why it often goes unnoticed in day-to-day operations.

Why Traditional Monitoring Doesn’t Unlock Throughput

Most pasteurization monitoring approaches were designed primarily for compliance, not optimization. They are effective at confirming minimum PU delivery, but they fall short when it comes to improving throughput.

Common limitations include:

- Measuring water or surface temperature instead of internal product temperature

- Relying on snapshots rather than continuous monitoring

- Reviewing data after production instead of during it

- Limited ability to compare PU delivery across SKUs

Without continuous cold-spot data, operations teams are forced to assume worst-case conditions. Conveyor speeds remain conservative, thermal inputs remain high, and tunnel settings remain locked in place.

This is the gap that can be addressed by the SCOUT, Extant’s in-package monitoring device. The SCOUT travels through the tunnel with the product, measuring temperature at the geometric cold spot throughout the entire pasteurization cycle. Instead of inferring lethality, it directly measures it.

When Pasteurization Data Becomes Actionable

Once cold-spot PU data is available in real time, excess margin becomes measurable rather than assumed. Differences between SKUs can be quantified, and over-pasteurization becomes visible.

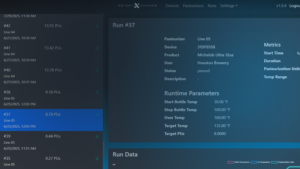

At this stage, visibility matters as much as measurement. The COMMANDER, Extant’s base station and dashboard, aggregates SCOUT data across runs and SKUs, presenting live PU curves, thermal profiles, and historical trends in a format that operations and quality teams can interpret without manual reconciliation.

With this level of insight, breweries can:

- Compare PU delivery across SKUs

- Identify run-to-run variability

- Evaluate conveyor speed changes safely

- Quantify available throughput margin before adjustments

Decisions move from legacy settings to data-driven control.

Why Continuous Data Integrity Matters

Throughput optimization depends on uninterrupted data. Gaps in monitoring force teams back into conservative operating modes and erase gains achieved through optimization.

To address this, you can use the LIEUTENANT, Extant’s bridge between the pasteurizer floor and reporting systems. The LIEUTENANT ensures that data is continuously captured, securely stored locally if connectivity is interrupted, and synchronized automatically once the connection is restored.

From an operational perspective, this eliminates missing runs, incomplete PU records, and reliance on manual backfilling, which is critical for both optimization and audit readiness.

From Data to Revenue Impact

Even with accurate, continuous data, most breweries do not have the internal expertise to translate thermal profiles into safe operational changes. Knowing that margin exists is different from knowing how to reclaim it without increasing risk.

This is why Extant combines monitoring with process consulting. The SCOUT, the COMMANDER, and the LIEUTENANT provide the data foundation, while expert analysis converts that data into validated adjustments, SKU-specific tunnel tuning, and quantified financial impact.

This reframes pasteurization as a tunable process rather than a fixed bottleneck, creating a clear opportunity to grow revenue without major capital investment.

Proving the Opportunity With Minimal Risk

Because optimization carries understandable concern, Extant typically begins with a limited pilot. Live production data is collected and analyzed to quantify potential throughput before any permanent changes are made. If no meaningful capacity is identified, the existing operating model remains unchanged.

What this approach consistently reveals is that most tunnel pasteurizers are not underperforming due to poor design or maintenance, but because they are operated without clear visibility into available margin.

That invisible margin can represent hundreds of thousands of dollars in lost profit each year. Once it is measured continuously, it can be managed and ultimately reclaimed.